“There will be a $45 increase in the Standard Premium Rate representing a 13.6% increase,” Minister of Health Kim Wilson said, adding that “the loss of insured adults due to unemployment or emigration is real” and “we have seen businesses and individuals terminate their more expensive private health insurance policies and transfer their healthcare coverage to HIP.”

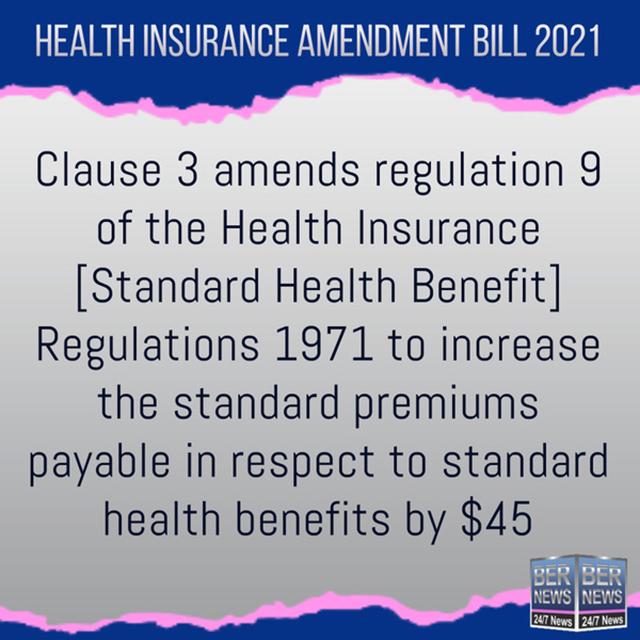

Speaking in the House of Assembly, the Minister said, “I have tabled in this House a Bill entitled the Health Insurance Amendment Act 2021 which introduces amendments to the Standard Premium Rate and enhanced benefits under the Health Insurance Plan [HIP] and FutureCare.

“BHB has been particularly challenged in meeting its commitments due to shortfalls with respect to the funding commitment it, in turn, requires to carry out its mandate. It has had significant additional expenses due to the pandemic [i.e. PPE and infection control costs] and, at the same time, it lost a substantial revenue stream due to the drop in visitors to the island, which previously generated as much as $8 million annually.

“The Covid-19 pandemic has upended many of the factors which previously informed the SPR,” the Minister said, adding that “for a start, the number of insured adults in Bermuda has decreased.”

“For an employment based health insurance scheme, this is critical,” the Minister said. “The loss of insured adults due to unemployment or emigration is real. It impacts the revenue which supports the organisations, programmes and insurance funds I just mentioned.

“In addition, Mr Speaker, with respect to utilization, both HIP and FutureCare have experienced increases in sign-ups. The Covid-19 pandemic has altered the economy with businesses contracting and downsizing.

“In the Ministry of Health, we have seen businesses and individuals terminate their more expensive private health insurance policies and transfer their healthcare coverage to HIP. And, as we all know, Bermuda has an aging population which naturally causes the burden on FutureCare to increase almost automatically.

“The main changes proposed in the Bill tabled today I will outline now.

“There will be a $45 increase in the Standard Premium Rate representing a 13.6% increase,” the Minister said.

“There will be a $30 increase in the HIP premium, representing a 6.9% increase. This will be accompanied by the introduction of a new prescription drug benefit covering 100% of costs up to $1000 in a policy year.

“There will be a $30 increase in the FutureCare premium, representing a 6% increase. This will be accompanied by an increase in the existing prescription drug benefit of $1000, taking it from $2000 to $3000.”

The Minister’s full statement follows below:

“Mr Speaker, today I have tabled in this House a Bill entitled the Health Insurance Amendment Act 2021 which introduces amendments to the Standard Premium Rate and enhanced benefits under the Health Insurance Plan [HIP] and FutureCare.

“The Health Insurance Act 1970 [the “Act”] forms the cornerstone of our current national health insurance system, and, together with Regulations made under the Act, it prescribes the minimum mandated package of health insurance for all. Specifically, the Standard Health Benefit [SHB] and Mutual Reinsurance Fund [MRF] make up the essential components of an insurance package that all employers must provide and all insurers must include in any policy.

“Mr Speaker, the SHB Premium portion covers select diagnostic imaging out of hospital [e.g. mammograms], select medical home care benefits [e.g. IV infusions], and select services that support home care.

“The MRF is a prescribed amount which each insurer pays into the pooled fund. It covers most local hospital-based care [inpatient and outpatient services], all insured persons’ kidney care [including transplants, antirejection drugs, transplant coordination and education]. In addition, the MRF may provide funding for programmes that support health for those vulnerable individuals that are uninsured and underinsured.

“The premium for the mandated package comprising the SHB and MRF is referred to as the Standard Premium Rate [SPR].

“Mr Speaker, the SPR is generally calculated on the basis of SHB claims experience, the headcount of insured individuals, projected changes in fees and utilization, and any benefit changes.

“Mr Speaker, I will pause here to further explain the role of the SPR.

“Honourable Members will recall the change the SPR in 2019, which called for $322 million to be transferred to the BHB in the form of a grant from the Government and a transfer from the MRF. The SPR also supports the Health Council, Chronic Disease Innovation Fund, full treatment for patients with kidney disease, the Enhanced Care Programme and Personal Home Care Programme. Additionally, it funds the administrative functions provided by the Health Insurance Department and provides subsidies to HIP and FutureCare.

“In this last year, Mr Speaker, the BHB has been particularly challenged in meeting its commitments due to shortfalls with respect to the funding commitment it, in turn, requires to carry out its mandate. It has had significant additional expenses due to the pandemic [i.e. PPE and infection control costs] and, at the same time, it lost a substantial revenue stream due to the drop in visitors to the island, which previously generated as much as $8 million annually.

“Mr Speaker, the Covid-19 pandemic has upended many of the factors which previously informed the SPR.

“For a start, the number of insured adults in Bermuda has decreased.

“Mr Speaker, for an employment based health insurance scheme, this is critical. Revenue targets for the SPR over the past two years were based on a reported 49,027 insured adults. That headcount is now reduced to 46,300 for calculation purposes [as of December 2020] but is reported to be a low 46,181 as recently as May 2021. The loss of insured adults due to unemployment or emigration is real. It impacts the revenue which supports the organisations, programmes and insurance funds I just mentioned.

“In addition, Mr Speaker, with respect to utilization, both HIP and FutureCare have experienced increases in sign-ups. The Covid-19 pandemic has altered the economy with businesses contracting and downsizing. In the Ministry of Health, we have seen businesses and individuals terminate their more expensive private health insurance policies and transfer their healthcare coverage to HIP. And, as we all know, Bermuda has an aging population which naturally causes the burden on FutureCare to increase almost automatically.

“Mr Speaker, each insured HIP and FutureCare client premium is subsidized by the MRF. The HIP subsidy currently represents 28% of the premium and the FutureCare subsidy is at 47%. As more businesses and residents join the plans, the increase in associated costs and volumes factor into the annual assessment of the SPR, HIP and FutureCare. In fact, the HIP and FutureCare premiums have not increased since September 2015.

“Mr Speaker, a most important element of the regular assessment of the SPR and the HIP and FutureCare plans is a review of the benefits themselves in the context of our population’s health needs.

“Mr Speaker, as I have indicated to this House before, pharmaceutical intervention saves money and interrupts the costs and burden of disease progression. For seniors on FutureCare, the coverage for prescription drugs comes with a cap of $2,000 a year. However, those residents on HIP must pay for all medications out of pocket. Enhanced prescription drug benefits for HIP and FutureCare clients are proposed with this legislation.

“Also, in assessing the benefits currently available, we have identified maternity care and maternal health education as a gap in service for uninsured women. To ensure all children have an equal and healthy start to life, all uninsured women must have access to health care and education at this critical point in their life and the life of their unborn and newborn children.

“Mr Speaker, Bermuda’s current market realities, including our headcount of insured individuals and changes in utilization and benefits, cause the Ministry to propose amendments to the premiums of the SPR, HIP and FutureCare. These amendments are based on a re-estimate downwards of the insured headcounts [to take into account the Covid economic effect], a review of existing benefit coverage and population health demands.

“Mr Speaker, most importantly, the proposed benefits are supportive of enhanced public health and improved equitable access to critical services.

“Mr Speaker, the main changes proposed in the Bill tabled today I will outline now.

“There will be a $45 increase in the Standard Premium Rate representing a 13.6% increase. This will account for a new reduced insured headcount to ensure the BHB revenue target is met; it will support continued treatment for kidney disease patients [the trend is an increase in dialysis patients of 10- 15% per year]; and, it will provide a new maternity care benefit for uninsured women which will secure more equitable access regardless of income, insurance or social status.

“There will be a $30 increase in the HIP premium, representing a 6.9% increase. This will be accompanied by the introduction of a new prescription drug benefit covering 100% of costs up to $1000 in a policy year.

There will be a $30 increase in the FutureCare premium, representing a 6% increase. This will be accompanied by an increase in the existing prescription drug benefit of $1000, taking it from $2000 to $3000.

“Mr Speaker, this Government remains committed to providing a system of health care that results in a healthier and more productive community.

“It must be stated, though, that we are in a period of transition brought on by the unanticipated and unexpected costs of the pandemic.

“Mr Speaker, globally, the pandemic has shone a bright light on healthcare, and all its many strengths.

“But it has also highlighted the weaknesses.

“It has highlighted that access to affordable, high quality healthcare is a basic human right, and one that this Government is committed to seeing introduced for everyone.

“Mr Speaker, our work on universal health coverage will set a new path for strengthening our health system. This work is ongoing, and we anticipate that, before the end of this year, we will be setting out the steps we have agreed with stakeholders from across the system to start this journey afresh.

“The pandemic has provided us with a new opportunity to work shoulder-to-shoulder.

“We must now continue this positive collaboration and develop a health system that we can all be proud of. Thank You Mr Speaker.”

The full Health Insurance Amendment Act 2021 follows below [PDF here]: