The BEDC will be “providing Covid-19 emergency grant funding” to “approved bars, nightclubs, members clubs and restaurants” with maximum grant amounts to range “from $5,000 to $7,000 per business.”

This follows after the industry — which already had mandated closures in the ‘lockdown’ earlier this year — has been affected again, with all indoor bars and clubs ordered to close as of December 8th, and all businesses of any form directed to close by 10pm as of December 12th.

A BEDC spokesperson said, “The Bermuda Government is sensitive to the immediate economic impact felt by those bars, nightclubs, member clubs and restaurants that have been negatively impacted due to the mandatory public health closures issued by the Ministry of Health due to the rise in Covid-19 cases.

“To assist those affected businesses, the BEDC will be providing Covid-19 emergency grant funding out of the $12M that has been allocated to assist businesses during Covid- 19.

“The one-time grant relief is a needs-based funding product that will be available specifically for approved bars, nightclubs, members clubs and restaurants as of December 8th, 2020. The relief will be granted on a case-by-case basis. Businesses must be registered with BEDC to apply.

“With effect from 9 am on Thursday December 17th, entrepreneurs with businesses that are impacted can go online to www.bedc.bm to apply for the emergency grants.

“Funds will be provided to cover immediate, monthly overhead expenses, excluding salaries which are being met by the Government’s Unemployment Benefit. Approved grants will only be provided for the following overhead expenses: business location rent, utilities, social insurance, and health insurance premiums.

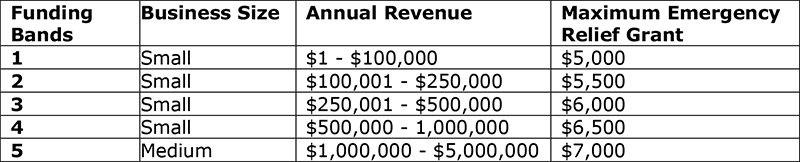

“Funding thresholds will remain divided into the 5 bands of financing established in April as part of BEDC’s Covid-19 Business Continuity & Sustainability Funding Programme. The first 4 Bands are allocated to small businesses and the last band is earmarked for medium-sized businesses as defined by BEDC’s legislation.

“Maximum grant amounts will range from $5,000 to $7,000 per business depending on the size of the business defined by its annual revenue generated over the last 12 months between December 2019 and November 2020 as follows:

“Funding levels are maximum amounts validated by submission of invoices and bills for the 4 identified overhead expense areas.

“BEDC has set aside a total of $1M out of the $12M in Covid-19 funding support provided by the Government for this emergency relief. As is the case with all BEDC financial products, applications will be reviewed, and funds provided based on need.

“The BEDC Covid-19 Emergency Grant will be in place until the funds are exhausted or until deemed no longer necessary.

“BEDC is also working to further expand the existing Covid-19 Business Continuity & Sustainability Funding Programme that was launched in April 2020. After 9 months of providing support for businesses immediately impacted by Covid-19, it is evident that funding support needs to be expanded.

“This further expansion will allow the BEDC to consider all requests for financial support, including stimulus and innovative business ideas, and to utilize available funds to support more viable businesses in need. The programme will continue to work within the BEDC’s existing funding capabilities to best leverage the total funding available and assist as many businesses as possible.

“Business owners will be able to utilize a combination of BEDC financial products, Bank financial products, and Credit Union financial products to maximize their ability to get the capitalization they need to survive, thrive, pivot, and even start their business. More details of this expansion to the Funding Programme will be provided on Monday, December 21st.

“For more information about the Covid-19 Emergency Grants and BEDC’s Covid-19 Funding Programme, visit the BEDC website at www.bedc.bm, or email info@bedc.bm.”