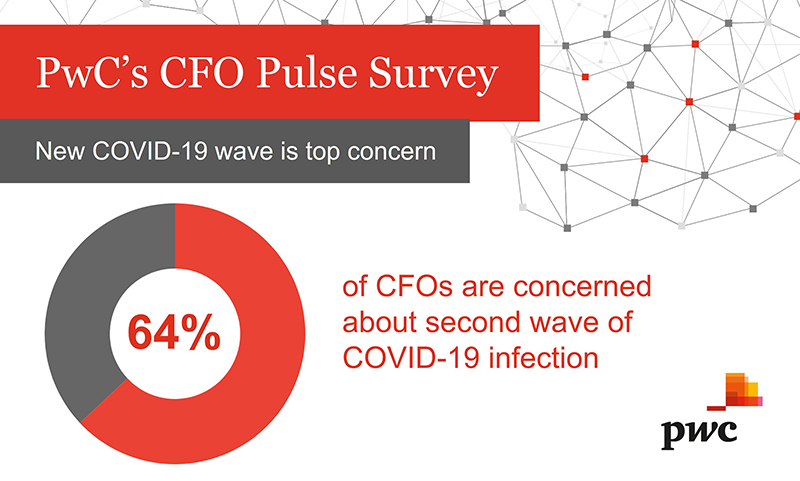

PwC recently conducted a Covid-19 CFO Pulse survey, with 64% of CFOs in the Caribbean region saying that they are concerned about the second wave of the coronavirus infection.

A spokesperson said, “As businesses bring people back to work sites that have fundamentally changed, PwC’s latest COVID-19 CFO Pulse Survey reveals their greatest concern is a new wave of coronavirus infection [64%]. This concern is closely followed by the impact of a global economic downturn [61%].

“The survey of 989 CFOs in 23 countries and territories, including over 40 CFOs in Bermuda and across the Caribbean, was conducted 1-11 June. It’s clear from PwC’s sixth COVID-19 CFO Pulse Survey that CFOs are focusing on regaining their footing, rebuilding revenue and reshaping their businesses.

“The majority of CFOs surveyed in Bermuda and the Caribbean expect COVID-19 to decrease revenue/profits by 10% or more [66%], with 11% stating while they expect a decrease the range is unknown and 2% saying the impact is too difficult to assess at this point. Most CFOs [70% compared to 63% globally] cite offering new or enhanced products or services as most important to rebuilding or enhancing their revenue streams. None are considering making cuts to digital transformation or cybersecurity.

Arthur Wightman, PwC Bermuda territory leader, comments: “Finance leaders are shifting their focus to how they can create sustainable business models that can adapt to the new realities of working and doing business in a challenging era of unpredictability. In many cases this will mean innovating new products and services that will work for consumers amid continued social distancing and other health and safety measures. Companies will also need to implement the right measures to keep their employees safe and look at new ways of working to survive and thrive moving forward.”

He adds: “We are facing one of the most challenging times in history. Business leaders have an obligation to step up and deliver on the larger purpose of the corporate community — creating opportunity and growth so that we can invest in people, communities and the overall economy.”

James Ferris, PwC Bermuda Advisory leader, comments: “Businesses that are succeeding are those that listened to their employees and embraced a digital mindset to keep them safe and working during the crisis. With a growing importance on rebuilding revenue, they need to also listen to their customers and embrace a similar digital mindset to transform, innovate products and services and offer a new experience rooted in technology.”

Caribbean edition survey highlights:

Financial Actions:

- 77% of respondents are considering implementing cost containment

- 50% of respondents are considering deferring or canceling planned investments as a result of COVID-19

- 0% of CFOs are considering cuts to digital transformation, cybersecurity and research & development

Workforce Impact:

- 32% say in the next month they expect a productivity loss due to lack of remote work capabilities

- 34% say in the next month they expect a change in staffing due to low/slow demand [temporary furloughs]

Return to the Workplace:

- 77% are very confident they can meet customers’ safety expectations

- 82% are very confident they can provide clear response and shut-down protocols if COVID-19 cases in their area rose significantly or if there was a second wave of infections

- 73% are very confident they can provide a safe working environment

Emerging Stronger:

- 77% say the current work flexibility will make the company better in the long run [e.g., hours, location]

- 59% say the current situation has resulted in better resiliency and agility which will make the company better in the long run

- 70% say technology investment from the current situation will make the company better in the long run

- 59% say the current situation has resulted in new ways to serve customers, which will make the company better in the long run

“PwC COVID-19 CFO Pulse Survey The first iteration of the Pulse Survey was conducted March 9-11, 2020; the second took place from March 25-27, 2020; the third was conducted between April 6-8, the fourth from April 20-22 and the fifth May 5-7. You can view all findings and insights by visiting here.”

The full Pulse Survey follows below [PDF here]